- By Admin

- January 24, 2025

Why Sports Betting Companies Are Profitable Investments

The global sports betting industry is booming, with revenues exceeding $100 billion annually—and it’s only getting bigger. As legalization spreads and technology advances, investing in sports betting companies (or platforms like BetZono) has become one of the most lucrative opportunities in the gambling sector.

But what makes sports betting such a profitable business? And how can you capitalize on this growth? Let’s break it down.

1. The House Always Wins: The Vigorish (Juice) Advantage

Sportsbooks don’t need to predict winners—they just need balanced action.

- Every bet comes with a built-in commission (vigorish or "vig"), typically 5-10% of losing wagers.

- Even if bettors win, the bookmaker adjusts odds to ensure long-term profitability.

- Example: If $1M is wagered on a game, the sportsbook keeps $50K–$100K regardless of the outcome.

Investor Takeaway: Sports betting is a volume business—more bets = more guaranteed profit.

2. Explosive Market Growth & Legalization Wave

- Global sports betting revenue is projected to hit $182B by 2030 (CAGR: 10.3%).

- U.S. expansion: Since the 2018 PASPA repeal, 30+ states have legalized sports betting, with more on the way.

- Europe & Asia: Already massive markets, with mobile betting driving record growth.

Investor Takeaway: Early investors in regulated markets see the biggest returns.

3. Digital Dominance: Online & Mobile Betting

- 80%+ of bets are now placed online (vs. traditional bookmakers).

- In-play/live betting (wagering during games) accounts for 60%+ of revenue—higher margins than pre-match bets.

- AI & data analytics optimize odds in real-time, maximizing profits.

Investor Takeaway: Platforms like BetZono capitalize on this shift with scalable, tech-driven models.

4. Recurring Revenue from Loyal Customers

- Sports bettors are highly engaged, placing 20+ bets per month on average.

- Subscription models, VIP programs, and bonuses keep players coming back.

- Cross-selling: Many bettors also play casino games, doubling their lifetime value.

Investor Takeaway: Customer retention = predictable, long-term cash flow.

5. Low Operational Costs, High Margins

- Unlike casinos, sportsbooks don’t need physical locations, dealers, or slot machines.

- Automated risk management reduces staffing needs.

- Margins can exceed 15% for well-run operations.

Investor Takeaway: More profit flows straight to investors & shareholders.

How to Invest in Sports Betting Profits (Without Starting a Bookmaker)

Most people can’t launch their own sportsbook—but you can invest

in:

✅ Publicly traded betting stocks (DraftKings,

Flutter Entertainment, Entain)

✅ Profit-sharing platforms (Like

BetZono’s Sports Pool, where you earn from real betting activity)

✅ Blockchain-based betting protocols (Decentralized,

transparent revenue sharing)

🔥 Why BetZono?

- No need to pick winners—you profit from the entire betting market.

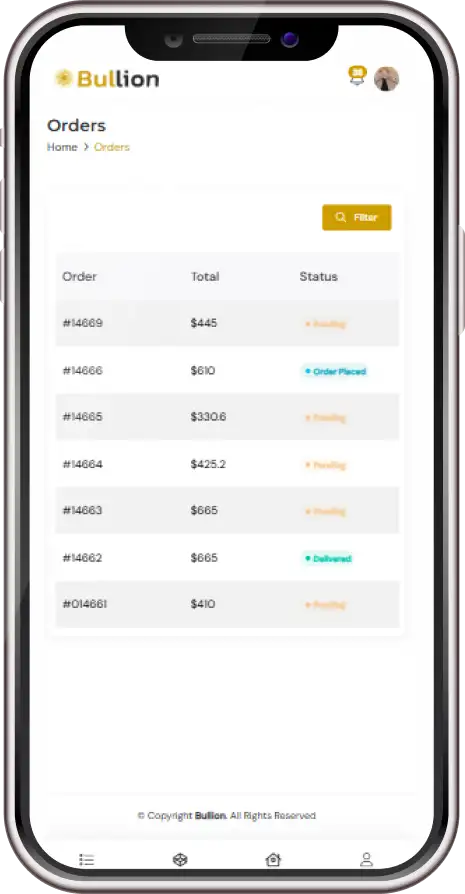

- Transparent payouts—real-time tracking of your earnings.

- Diversified exposure—combine sports with casino, esports, and crypto betting.

Final Verdict: Sports Betting is a Cash Machine

With high margins, recurring revenue, and global expansion, sports betting companies (and investment platforms like BetZono) offer a low-risk, high-reward way to capitalize on this booming industry.

🚀 Want in? [Invest in BetZono’s Sports Pool Today]